Rich Dad Poor father’s author Robert Kyosaki has issued a strong warning about the status of the American economy. Amidst these concerns, Kiyosaki has predicted that the BTC price may increase between $ 500,000 and $ 1 million, today there is a new all-time high setting between bitcoins.

Robert Kyosaki concerns about American bond auction

Robert Kyosaki Recent Comments An American Treasury Bond held on 20 May was triggered by the auction. Amir Dad poor father writer said that no buyer appeared in the auction and alleged that the Federal Reserve himself had to buy bonds worth $ 50 billion.

However, the US Treasury Department released the data, with the dialect-to-cover ratio of 2.97, with $ 212.58 billion and $ 74.38 billion in the bid. According to the official record, only $ 4.38 billion was awarded to the Federal Reserve account. This suggests that the participation was higher than the kiosaki.

Despite this, Robert Kyosaki warned that the incident indicates a deep issue in the financial system. He described the fed action as “fake assets to buy fake funds” and stated that it marked the breakdown of confidence in American debt.

Hyperineflation warning amid growing market pressures

Robert Kyosaki claimed that the United States has entered a phase of hyperflation. They believe that the money printed by the government will reduce the value of the dollar quickly.

“Hyperineflation is here,” he said on X. “Millions, young and old, to erase financially.” According to him, savings will lose the price rapidly, and traditional financial systems may not be able to protect the money.

He had earlier warned that US credit rating downgrade And excessive debt can trigger a major financial crisis. His latest comments follow this subject of economic breakdown.

Bitcoin, gold and silver as money safety

As a reaction he sees as a collapse dollar, Robert Kiyosaki, the author of the rich father poor father, believes that investors will shift to the property with a limited supply. Despite that BTC prediction for $ 250K before thisThe predicted bitcoin can reach between $ 500,000 and $ 1 million. Gold, he said, $ 25,000 an ounce, and silver can climb up to $ 70 an ounce.

He considers these assets a better storehouse of value at the time of high inflation. “Buy more. Don’t sell,” he advised, urged followers to keep bitcoins. He also warned against relying on bitcoin ETF, called him “toilet paper” in the earlier post.

Robert Kyosaki has long supported bitcoin and regularly recommends to invest in “Real Gold and Silver and Bitcoin” to preserve money.

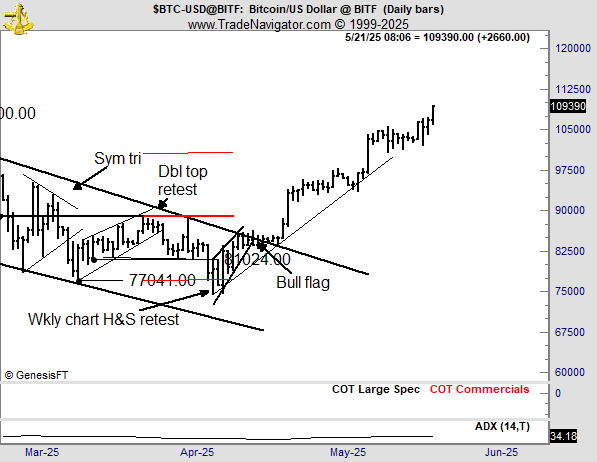

BTC price makes new all-time high hits

The bitcoin value now reached a record price of $ 109,424 as press time. Milestone Bitcoin reflects institutional interest including ETF inflow. Analysts say Cryptocurrency has entered the price discovery mode with a new high level.

Bitcoin analyst Peter Brant said that reaching bitcoin all-time high is a common part of a bull market cycle. He suggested a potential top of $ 125,000 to $ 150,000 by the end of August. In the midst of this trend, Jim Cramer encouraged the calm between increasing American debt concerns and being mentioned and mentioned and Bitcoin as a safe option,

As a result, while Robert Kyosaki’s upper forecast of $ 1 million is more extreme, it aligns with a wide rapid feeling in crypto space. They believe that the current financial crisis will accelerate this growth.

Disclaimer: The material presented may include the author’s personal opinion and is subject to the market status. Do your market research before investing in cryptocurrency. The author or publication does not have any responsibility for your personal financial loss.

share: