BTCS INC has increased its Ethereum (Eth) holdings up to 13,500 coins. It follows the recent acquisition of 1,000 ETHs for approximately $ 2.63 million. The purchase was made using its institutional trading services, through the crypto.com exchange. By June 2, this step marks an increase of about 50% in Eth Holdings since the end of Q1 2025.

The company is focusing on ETH as part of its comprehensive blockchain infrastructure strategy. As a result, its acquisition supports both its treasury model and infrastructure operations. The BTCs aim to build a scalable blockchain system and looks at Eth as central for these efforts.

BTCs 1,000 Etharium, Total Hits acquire 13,500

The firm BTCs continues to extend its blockchain operations and ethereum reserves. with Add Out of 1,000 ETHs, the company now holds around 13,500 ETHs. This increase reflects BTCS’s commitment to ethrium-based technologies, including its nodeps and builder+ activities.

BTCS CEO Charles Alan said, “Etharium lives at the core of our blockchain infrastructure strategy.” He said that ET acquisition is a by -product of the development of their infrastructure and not only a digital asset reserve. The company is working to scale the revenue-generating blockchain services working on the network of the Etharium.

BTCS is not only discovering atherium because it can increase the price. Instead, meditation is on long -term growth of resources and making services sustainable and now implementing ETHs in many areas of its business.

Crypto.com role in ETR acquisition

Eth was acquired through an institutional-grade trading platform crypto.com exchange. This exchange is designed for advanced and institutional users and provides deep liquidity and low delay. Crypto.com started offering American services in 2024 and has become a major platform for institutional crypto trading.

According to BTCs, it helped customize trade execution using crypto.com. The exchange reduced the slippeage and ensured cost -effective capital perfection.

“We have used the institutional offer of crypto.com … reducing the slipages and optimizing the capital purification,” Alan said.

Crypto.com President and COO Eric Anziani commented on the partnership: “We are proud to partner with BTCS in our Cryptocurrency Acquisition Strategy.” He said that the forum is designed to provide institutions with advanced equipment and liquidity for mass trades.

ETH reserves are increasing among public companies

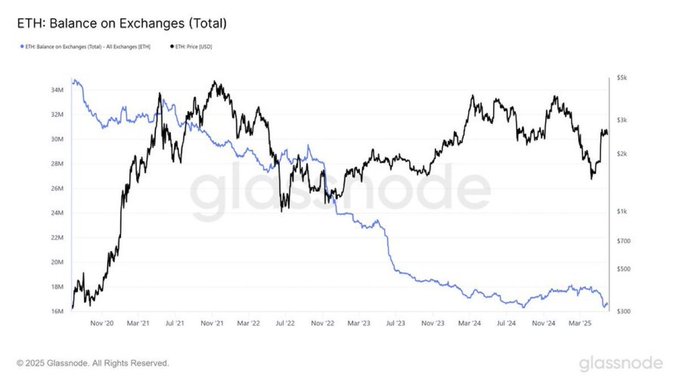

Subsequently, the Etharium Exchange Balance is now at its lowest point in seven years, according to on-chain data. There are more public companies Enhance their ath holdingsAnd supply on exchanges continues.

BTCS is one of the many firms enhancing ETH stores. Grassscale investment has about 1.85 million ETHs, Blacrock has about 1.05 million ETHs, and fidelity investment has about 460,900 ETHs. In addition, Abraxus Capital and others have also acquired large ETs.

Concurrent, Sharplink gaming also closed recently A private placement deal to create your atherium treasury. The company revealed that it aims to raise between $ 750 million and $ 1 billion. It is to cross the biggest reserves of ETH on the market and cross all.

Since corporate procurement of ETH is increasing, it can soon become an important focus for the Treasury and Infrastructure Plan of many firms, so that other people can do the same.

Disclaimer: The material presented may include the author’s personal opinion and is subject to the market status. Do your market research before investing in cryptocurrency. The author or publication does not have any responsibility for your personal financial loss.

share: